accounting & tax services

joey cheriscat

Invest your time and efforts on running your business. Leave the accounting to me.

Get an advance before your tax refund is available. Call our office for more information.

Get an advance before your tax refund is available. Call our office for more information.

WASHINGTON-The Internal Revenue Service reported that on Friday, February 12, 2021, when the tax agency will begin to accept and process 2020 tax year returns, the nation’s tax season will begin.

WASHINGTON-The Internal Revenue Service reported that on Friday, February 12, 2021, when the tax agency will begin to accept and process 2020 tax year returns, the nation’s tax season will begin.

The starting date for individual tax return filers on February 12 gives the IRS time to carry out additional programming and testing of IRS programs following the reforms in tax law on December 27, which offered a second round of Economic Impact Payments and other benefits.

To ensure IRS systems run smoothly, this programming work is important. If the filing season had been opened without adequate programming in place, the issuance of refunds to taxpayers could be postponed. These amendments guarantee that when they file their 2020 tax return, qualifying individuals will receive any leftover stimulus money as a Recovery Rebate Credit.

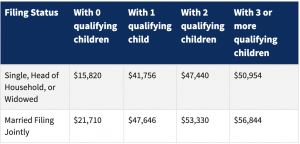

UNDERSTAND EITC-The EITC is a federal tax credit providing a financial leg up for hardworking American employees and families. In 2019, 25 million qualifying employees and families collected around $63 billion in EITC payments nationally. The payment was $2,476 on average. Via EITC, many working families earn more money than they pay in federal income taxes.

UNDERSTAND EITC-The EITC is a federal tax credit providing a financial leg up for hardworking American employees and families. In 2019, 25 million qualifying employees and families collected around $63 billion in EITC payments nationally. The payment was $2,476 on average. Via EITC, many working families earn more money than they pay in federal income taxes.

For 46 years, the EITC has been supporting low- and moderate-income employees. While it has been updated many times over the years, the vast majority of the program’s benefits go to families with kids.

Accounting Services- By working with an experienced team of industry leaders who apply their expertise to help you produce efficient, significant results that drive solutions, you decide to overcome your hardest challenges.

Accounting Services- By working with an experienced team of industry leaders who apply their expertise to help you produce efficient, significant results that drive solutions, you decide to overcome your hardest challenges.

Jal Tax Service conveys an extensive array of personalized consulting services including Shared Services Improvement, Shared Services Design, Shared Services Assessment and Planning, Shared Services Implementation SupportOur field of expertise include: Technology, Finance, and Accounting, Supply Chain, Multifunction/Global Business Services, Human Capital and More.

Accounting Services- Are you stressed out about your taxes and you’re not even sure if you’re doing them right? There’s really no need to look any further for the right tax specialist because at the end of the day, we realize that there are plenty of tax experts to choose from out there, but the question still remains: who’s the best? You can rest assured that we will get the job done quickly and effectively. Our customers come from far and wide because of the quality of our service. So if you would like to give us a try, then give us a call, mention discount code “Jaltax25” and we’ll do our best to get you the best possible price.

Accounting Services- Are you stressed out about your taxes and you’re not even sure if you’re doing them right? There’s really no need to look any further for the right tax specialist because at the end of the day, we realize that there are plenty of tax experts to choose from out there, but the question still remains: who’s the best? You can rest assured that we will get the job done quickly and effectively. Our customers come from far and wide because of the quality of our service. So if you would like to give us a try, then give us a call, mention discount code “Jaltax25” and we’ll do our best to get you the best possible price.

Sole proprietorship, LLC, partnerships, S and C corporation can stand to benefit from a personalized tax plan. Companies reforming their business’s structurecan decrease to tax obligation to the bare minimum. Aside from reforms, your company can acquire help with payroll taxes, sale, and use taxes, workers’ compensation issues, personal property tax, and annual report filing. Get the best tax preparation services. Give us a call to learn more about our expertise.

Financial Advisory- Whether you are planning for retirement or simply creating a personal budget, it doesn’t hurt to get help from an expert. Luckily, there is no shortage of financial experts offering advice these days. But, every person’s financial situation is unique and may require the services of a specialized financial professional. When you consider Jal Tax as your service provider, we will rank up there with your doctor or lawyer. As a financial advisor, we aim to help you manage your money. We recommend what and when our clients should buy, sell, or hold depending on market conditions and our client’s goals. We operate under a suitability standard, meaning the recommendations we make must be based on a client’s objectives and risk tolerance.

Financial Advisory- Whether you are planning for retirement or simply creating a personal budget, it doesn’t hurt to get help from an expert. Luckily, there is no shortage of financial experts offering advice these days. But, every person’s financial situation is unique and may require the services of a specialized financial professional. When you consider Jal Tax as your service provider, we will rank up there with your doctor or lawyer. As a financial advisor, we aim to help you manage your money. We recommend what and when our clients should buy, sell, or hold depending on market conditions and our client’s goals. We operate under a suitability standard, meaning the recommendations we make must be based on a client’s objectives and risk tolerance.

Here at Jal Tax, we also operate under a strict fiduciary standard. This standard requires us to put our client’s interests above our own. You might have questions about a specific situation such as buying a house, getting married, or paying for your children’s education. Maybe you want help with insurance, tax guidance, or debt counseling. Or you may simply need to build a long-term financial roadmap. Ultimately, every person’s financial situation is different., It’s important that you have the skills and experience best suited for your circumstances. We should be able to assess your financial needs to help you achieve your goals. Our staff will act in your best interest and be committed to providing unbiased advice to help you plan for an uncertain future with confidence.

Why choose me

Accurate record keeping

Our Service Commitment

At Jal Tax Service, we are committed to providing the best possible service and advice to all our customers.Our experienced team will help you to make the right decision and they will work with you to resolve any problem you may have.Our business is to look after yours, with our friendly and experienced team, we will always be available to help you.

Experience

For over 20 years, we have been helping individuals and businesses resolve their tax problems.our experienced and dedicated team here can help with your bookkeeping, payroll and tax preparation needs. Small or complex cases, leave them up to us.

Personalized Service

Your complete satisfaction is our priority therefore, we give you personalized attention. We usually create time to communicate with you and build a good relationship that brings results. We are available to assist you with your tax and accounting needs promptly and courteously. In other words, once you get your taxes done through our company, you put yourself in the hands of some of the best professionals in the tax and accounting market, specialist who place your interests at the top of their daily preference agenda.

Testimonials

What my clients say?

Coronavirus Tax Relief

Coronavirus Tax Relief http://jaltaxservice.com/index.php/tax-news/

http://jaltaxservice.com/index.php/tax-news/